Unlocking The Power Of

Your Credit

Unlocking the power of your credit isn’t just about boosting your score it’s about creating options, gaining freedom, and building a future where your goals aren’t limited by money.

WHAT WE CAN REMOVE

EVICTIONS

MEDICAL BILLS

STUDEN LOANS

REPOSSESSIONS

CHARGE-OFFS

HARD INQUIRES

BANKRUPTICES

INQUIRES

MEDICAL BILLS

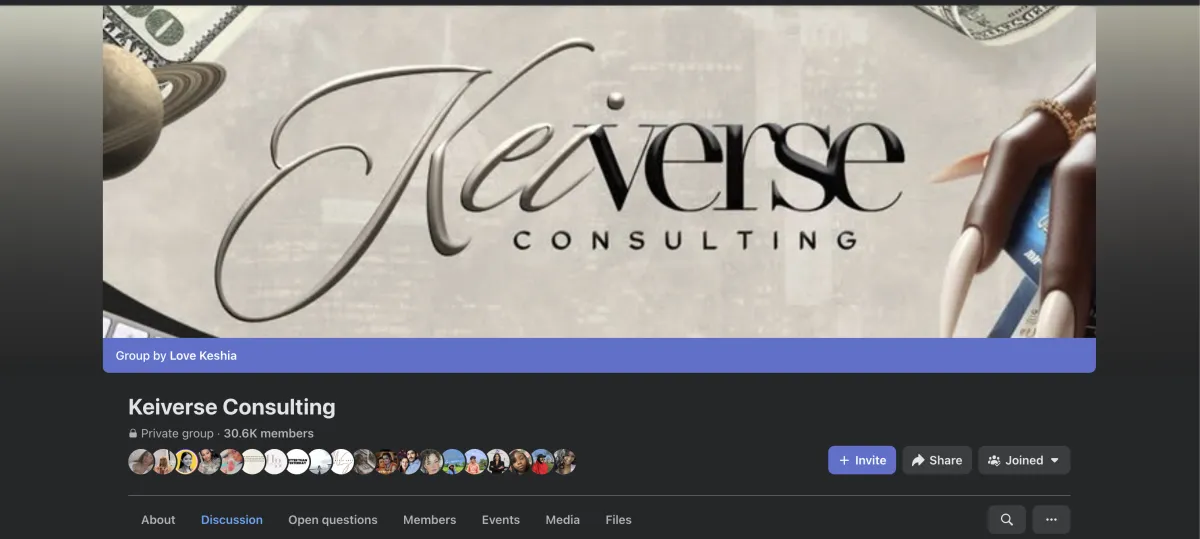

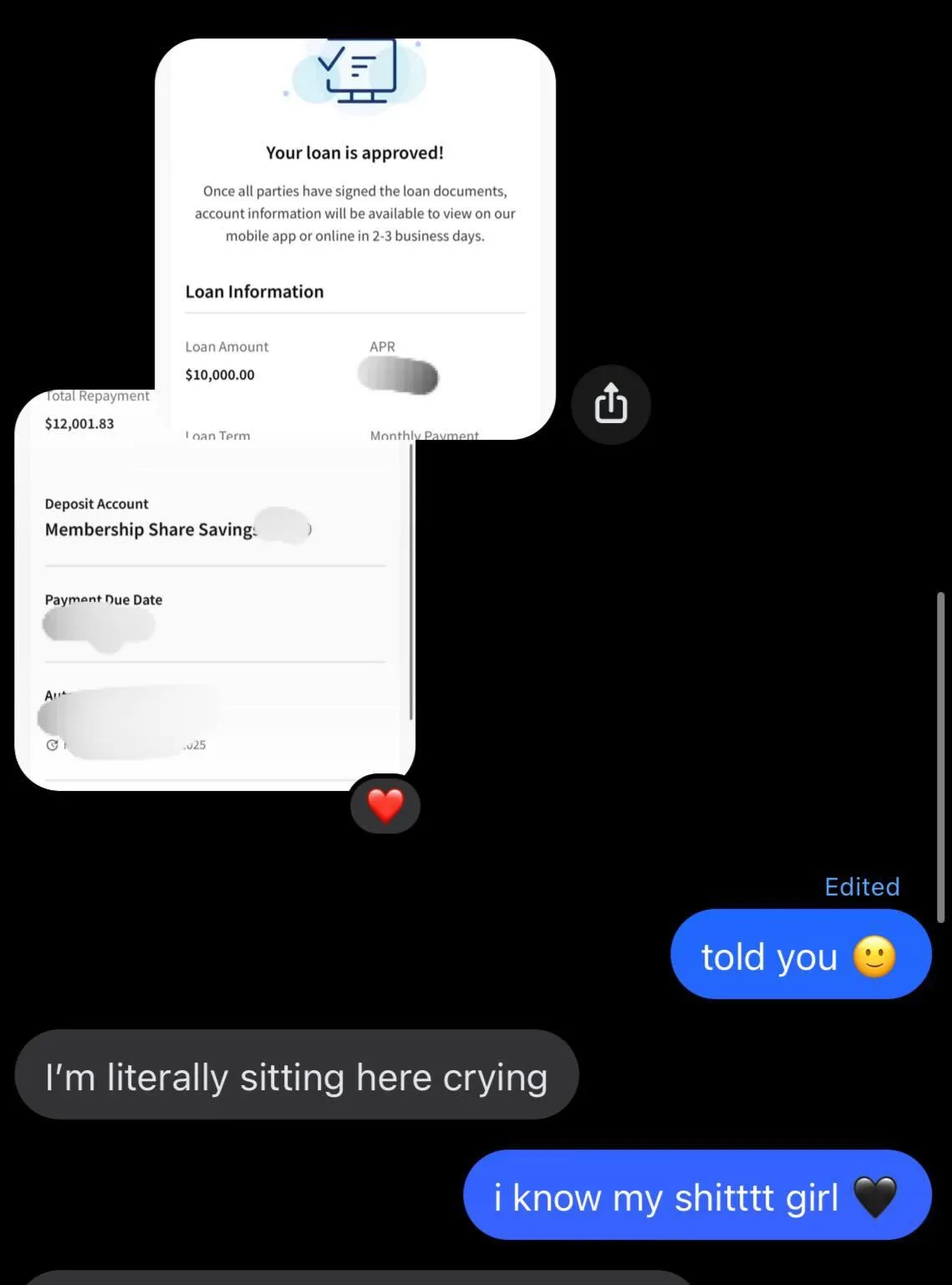

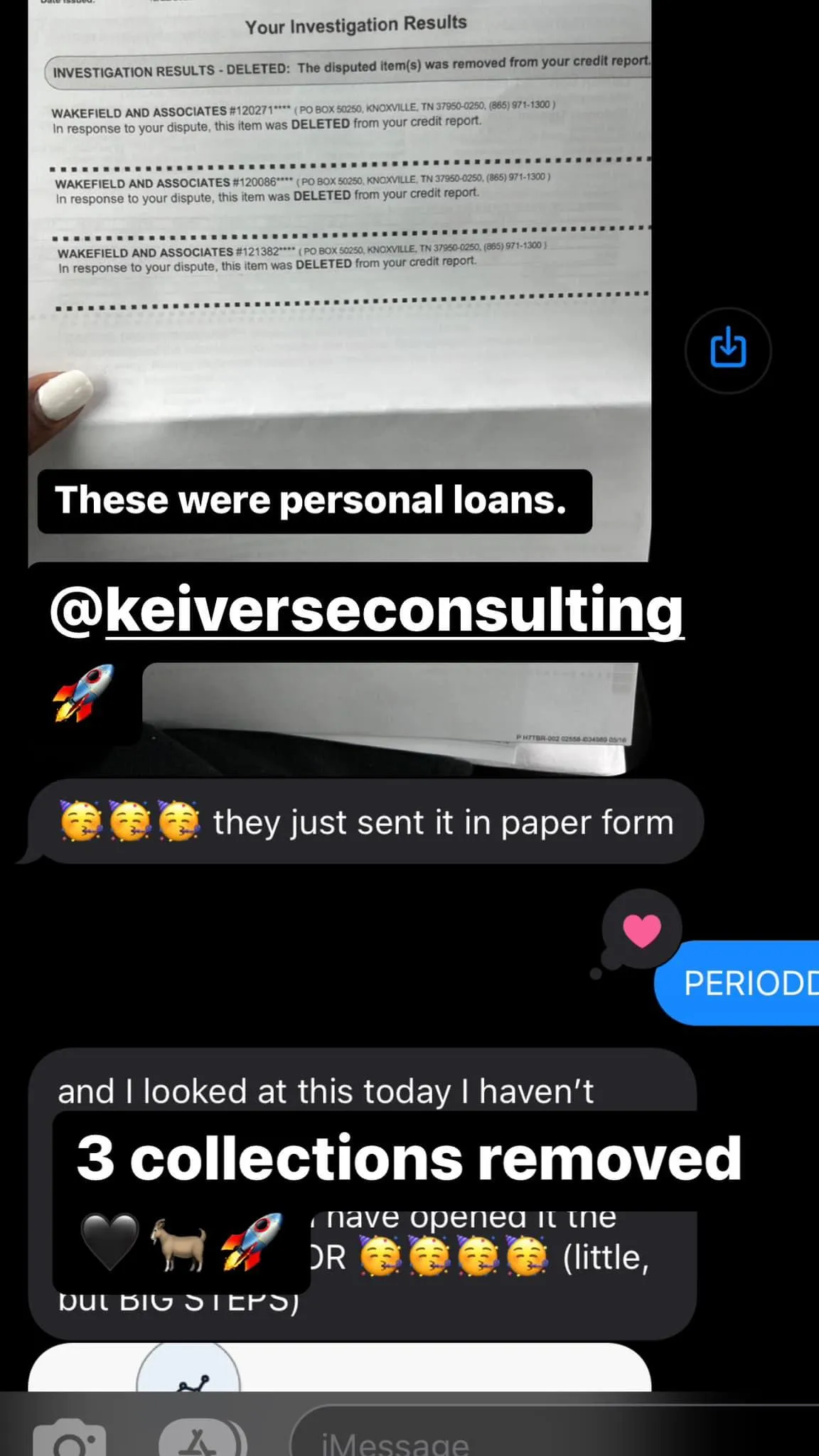

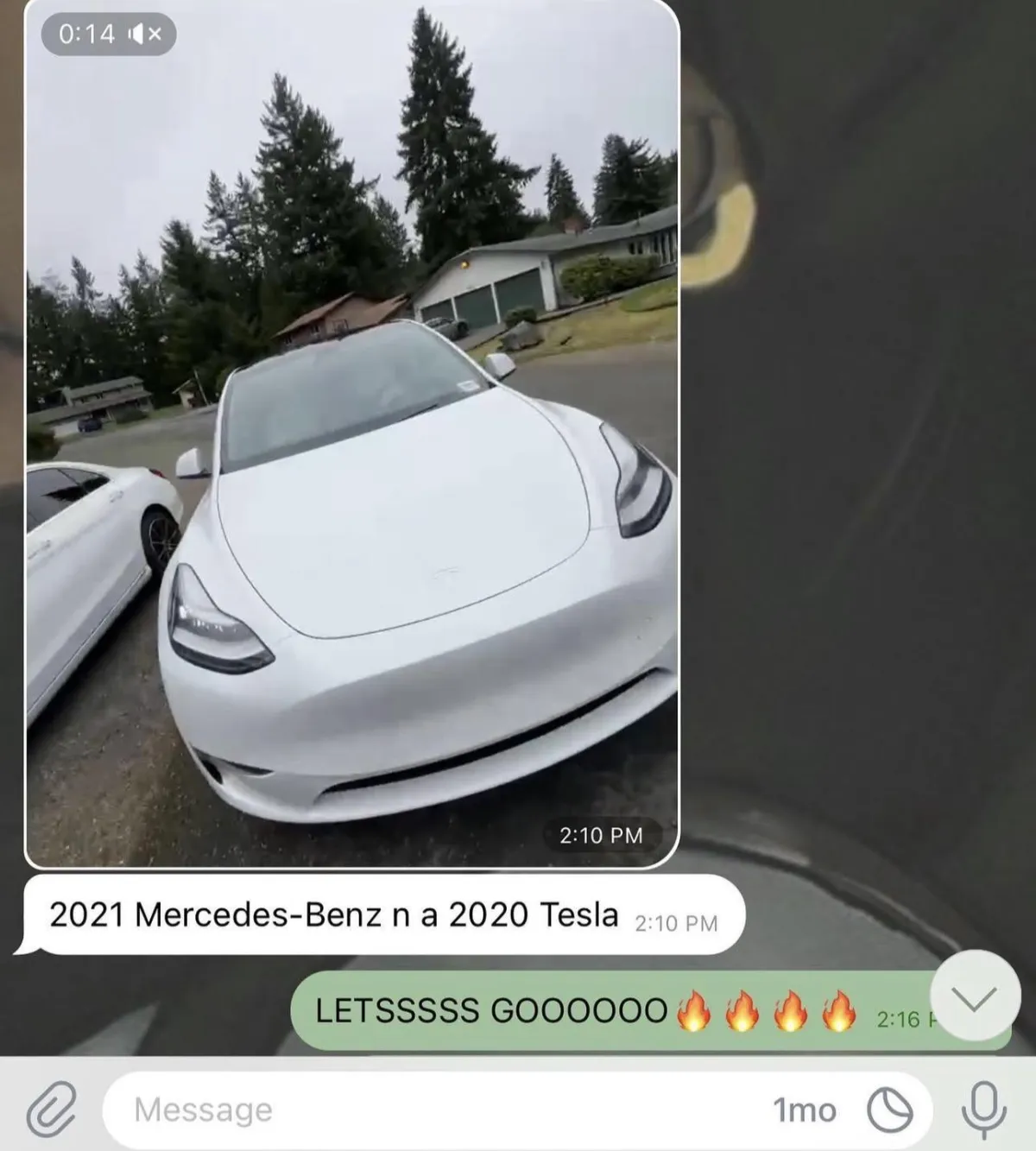

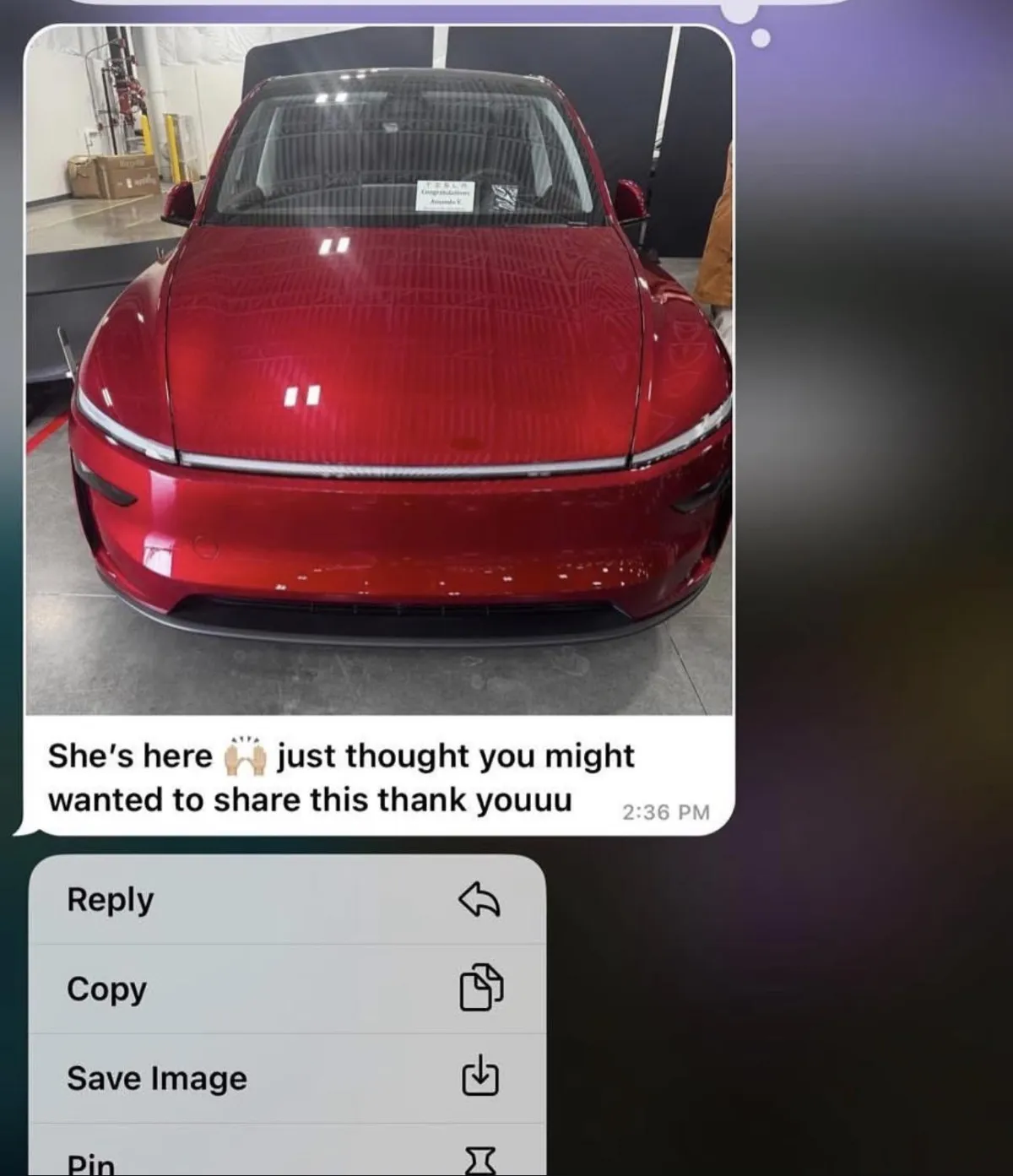

Real Clients, Real Results

Don’t just take our word for it ; see the real success stories from our clients after signing up.

Your Credit Transformation: Problems vs. Solutions

See how repairing your credit opens doors to financial freedom and opportunity

Your Old Credit

New Way

High interest rates on loans and credit cards

Lower interest rates, saving money on payments

Difficulty renting apartments or housing

Easier rental approvals and better leasing opportunities

Poor credit score causing stress and worry

Improved credit score and financial confidence

Limited financial opportunities

Greater financial opportunities for personal and business growth

Errors or inaccuracies on credit report

Disputed and corrected items, more accurate credit history

Explore Our Credit Repair Services

Programs and services designed to help you repair, build, and manage your credit.

Exclusive One-on-One Coaching

Our One-on-One Credit Mentoring goes beyond improving your personal credit we’ll guide you step by step on how to start and run your own credit repair business. You’ll work directly with a dedicated mentor who will teach you the strategies, tools, and industry knowledge needed to launch a successful credit repair service.Through personalized sessions, you’ll learn how to analyze credit reports, dispute inaccuracies, help clients improve their scores, and manage the business side of credit repair.

Total Price: $ 1,500

Basic Credit Repair Plan

This program includes a detailed credit analysis, six rounds of disputes, access to a 24/7 client portal, email and text support, credit education, and credit building support. It is designed for clients with small collections and no repossessions or evictions.

One- Time Payment: $550

Elite Credit Repair Plan

This 12-month program includes a detailed credit analysis, multiple rounds of disputes, access to a 24/7 client portal, email and text support, credit education, and credit building support. It is designed for clients with repossessions, evictions, student loans, and includes assistance with establishing two primary trade lines.

One-Time Fee : $950

Couples Elite Credit Repair Plan

This 12-month program is designed for couples and includes a detailed credit analysis, multiple rounds of disputes, access to a 24/7 client portal, email and text support, credit education, and credit building support for both partners. It is ideal for clients with repossessions, evictions, student loans, and includes assistance with establishing two primary trade lines for each partner.

One-Time Fee : $ 1,400

DISCOVER THE DIFFERENCE

Unlock the Power of Consistent Trading Results

Say goodbye to uncertainty and inconsistent profits. With our proven, data-driven strategies, we’ll help you trade with confidence, efficiency, and success.

High interest rates on loans and credit cards

Lower interest rates, saving money on payments

Difficulty renting apartments or housing

Easier rental approvals and better leasing opportunities

Poor credit score causing stress and worry

Improved credit score and financial confidence

Limited financial opportunities

Greater financial opportunities for personal and business growth

Errors or inaccuracies on credit report

Disputed and corrected items, more accurate credit history

Here's How it Works

This is a step-by-step process on how our program works.

Choose A Plan

Once you’re onboarded, our team immediately gets to work on your behalf. We carefully review your credit reports to identify any inaccurate, outdated, or negative accounts that may be holding your score back.

From there, we prepare and send your first round of disputes challenging those items directly with the credit bureaus and creditors. Our goal is simple: to remove harmful entries as quickly as possible and help you start rebuilding your credit with confidence.

We Will Start Your Disputes

Once you’re onboarded, our team immediately gets to work on your behalf. We carefully review your credit reports to identify any inaccurate, outdated, or negative accounts that may be holding your score back.

From there, we prepare and send your first round of disputes challenging those items directly with the credit bureaus and creditors. Our goal is simple: to remove harmful entries as quickly as possible and help you start rebuilding your credit with confidence.

Experience Real Credit Score Improvements

Let our team handle the hard work of removing negative items while giving you the credit education and tools you need to build lasting financial success.

Progress can be tracked in your client portal.

We will update you every 30-45 days.

Stay Connected, Stay Ahead.

JOIN THE SUCCESS JOURNEY

Join Our Facebook Community

Get free credit tips, learn how to boost your score, and connect with others on the same journey.

Frequently Asked Questions

FAQ

Everything you need to know about our program.

How quickly can I expect to see results?

Results vary depending on each client credit report , but many of our clients start seeing improvements within 30-45 days after signing up for our services.

How do I get started??

To get started just click the "Get Started" button or Book A Consultation and someone from our team will reach out.

How long does it take to fix my credit?

The time it takes to improve your credit depends on your current situation and the program you choose. Our Basic Credit Repair program is a 6-month process designed to address common credit issues such as late payments, small collections, and inaccurate information. The Elite Credit Repair program is a 12-month process created for clients with more complex challenges or those looking for a deeper, long-term strategy for financial stability.

We want to be completely transparent there’s nothing “magical” about credit repair. It takes time, effort, and patience. Our team can’t promise overnight results, but we do promise to work hard, stay consistent, and do our job to make sure you’re satisfied with the process and progress. Every credit profile is different, so results will vary, but with your patience and our dedication, we’ll get you moving in the right direction.

How can I track my progress?

Once you sign up, you’ll have access to a 24-hour client portal where you can track the progress of your credit repair journey at any time. This portal allows you to see updates, disputes, and overall improvements as we work on your credit.

In addition, to monitor your actual credit scores and reports in real time, you will need to sign up for a credit monitoring program. This program lets you track changes to your credit and ensures you stay informed about your progress outside of the portal.

By using both the portal and a credit monitoring program, you’ll have complete visibility into your credit repair process every step of the way.

What happens after I complete the program?

Once you complete your credit repair program, you will have a cleaner, more accurate credit report and a solid understanding of how to maintain and continue improving your credit. While we cannot guarantee permanent results because your ongoing financial habits and new credit activity will affect your scores you will leave the program equipped with the tools and knowledge to manage your credit responsibly.

You will also continue to have access to your client portal for reviewing past progress and results. Many clients choose to continue monitoring their credit through a credit monitoring program to ensure they stay on track and catch any changes or issues early.

Please note, any new items that appear on your credit report after program completion will not be covered under the original program and will require additional services if you want them addressed.

Completing the program is not the end it’s a step toward long-term financial health and stability.

More Results From Our Clients

Ready to Take Control of

Your Credit Future?

Book A Consultation

Schedule a one-on-one consultation with us, and we’ll review your credit report in detail. During this session, we’ll help you understand your current credit situation, identify areas for improvement, and outline the best steps to start repairing and building your credit.

FREE 20-MIN CONSULTATION CALL

Facebook

Instagram